Bonded by a resemblant fate, Suriname and Guyana are more than just neighbors divided by the Courantyne River. Once one territory, they lived a similar experience while separated and colonized by the British and Dutch empires.

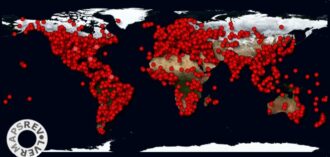

With more than a history of European colonization in common, these neighbors enjoy abundant natural resources, ranking among the top countries in the world by percent of tropical rainforest as land mass and are united by the Guyana – Suriname basin (GSB). The basin lies along the continental shelf of Guyana and Suriname and is estimated to contain around 13 billion barrels of undiscovered oil and 30 trillion cubic feet of undiscovered natural gas reserves, the world’s next offshore drilling hot spot.

As these two countries embark on the exciting journey of exploring their petroleum potential, the Guyana–Suriname Basin can represent either the rising of two Petro powers in the region in the years to come or the catastrophic fall into the obscurity of corruption and poverty.

Unlike Guyana, whose offshore exploration activity started in 2015 with its first crude oil production in 2019, Suriname’s first oil discoveries date back to the 1960s. In 1980 a wholly state-owned company was established – Staatsolie and in 1982 the first commercial onshore oil production in Tambaredjo oil field was initiated. As of 2021, Suriname’s proved crude oil reserves amounted to 89 million barrels, one of the lowest proved reserves in Latin America and the Caribbean, with a production of 6.14 million barrels from its 3 onshore fields in 2022. As a matter of fact, Suriname is among the world’s top gold producers, in rate of production relative to area, ranking 10th globally.

The country has a long history in mining, long before oil production. In 1916, the Aluminum Company of America (Alcoa) began mining bauxite in the then Dutch colony of Surinam, which over time became the country’s main export. Suriname’s economy is dominated by the extractive industries with exports of crude oil and gold accounting for approximately 85 percent and 27 percent of government revenues.

So, how did it happen for this resource rich country to be labeled as one of the poorest countries in Latin America?

Suriname had its resource wealth momentum from 2000 to 2014, similar in a way to Guyana’s now. The rise in international commodity prices resulted in a strong economic expansion for the country, 65% gain in GDP per capita, according to the Inter-American Development Bank. This made the country one of the fastest-growing economies in the LAC region with GDP per capita rising to nearly US$9,472 and a decline in poverty rates. The economy expanded from a little under US$1 billion in 2000 to US$ 5 billion in 2014.

However, these boom years were when the seed for the crisis was planted. In 2016 when the global oil prices dropped, so did the exports and the public revenues, and Suriname’s economy entered a free fall. This was topped with the announcement that Alcoa, the major aluminum company with over 100 years of operations in Suriname was ending its activity in the country. In 2016, Suriname’s GDP plummeted to 2008 levels and its dollar lost more than 46% value by the end of that year.

Currently, about 70 percent of the country’s population lives below the poverty line and is struggling with an inflation rate that has risen 60 percent since 2021. The economic collapse is so severe that Suriname defaulted three times on its sovereign debt and is currently following a range of economic reforms and austerity measures, part of the President Santokhi negotiated with IMF.

For Suriname, the natural resource blessing turned out to be more of a curse in disguise so far and this is what Guyana should pay close attention to while enjoying its oil euphoria.

Avoiding a state-dominant economy pitfall. As the common saying goes “Fish stinks from the head”, that’s exactly what has been going on in Suriname for decades.

The bitter aftertaste is the result of a tumultuous on-and-off ruling for 40 years of Desiré “Dési” Bouterse, Suriname’s then-most powerful person “convicted drug trafficker, alleged murderer and two-time president” who adopted deficient public policies, allowed corruption to flourish and mismanaged the economy which led Suriname’s gross domestic product to plunge by 16 percent, the worst decline in South America after Venezuela.

The early formation of state-owned companies and nationalization of extractive sectors of a country is usually a poor decision as it blocks foreign innovation, development, investments to make the sector competitive enough on the international stage. Also, when prematurely happening, as the formation of Staatsolie in Suriname, it tempts the government to control the wealth generated by the extractive sector to serve their own interests rather than its citizens, creating a perfect environment for corruption, nepotism and state-organized crime. The state-dominant economy trend can be noticed across the entire economy in Suriname, as according to the Inter-American Development Bank, as of 2015, there were 144 registered state-owned enterprises, with 60 % workforce employed in the public sector.

The important lesson for Guyana, which has been applied very well so far, is holding back from forming a national oil company yet. By doing so, the Guyanese government has been promoting more transparency in its oil extraction and production affairs on one hand, while on the other hand it has been able to attract more investments, know-how and expertise from the oil supermajors and gain access to a global market. Guyana has ten state-owned companies, which compete with the private sector for market share, opportunities and credit; therefore, government’s role now is critical around reforming and boosting the private sector environment by promoting investment, employment, financial support and technology development.

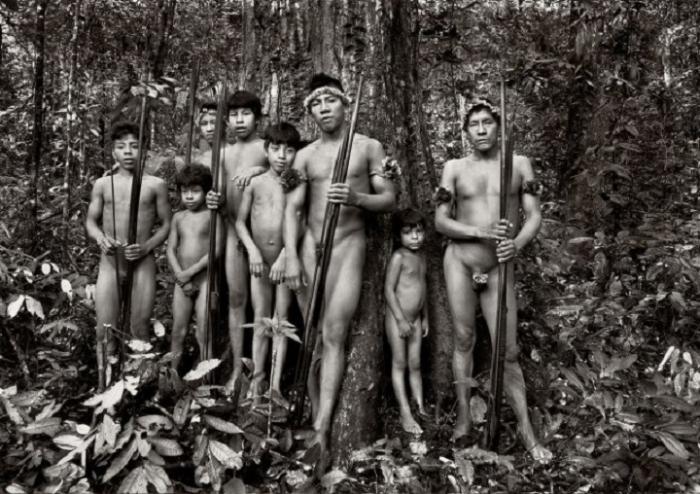

Going back to Suriname’s story, the gold sector remains up to today the main source of employment in the nation. Based on unofficial estimates, it employs about 70,000 non-registered miners, most are Brazilian immigrants called garimpeiros. It is estimated that at least 20,000 other workers are in mining-related jobs, such as hotels and bars or as sex workers in communities close to mines.

According to official data, in 2021 only, Suriname exported US$2.26 billion in Gold, making it the 32nd largest exporter of Gold in the world.

Even though mining has been the backbone of Suriname’s economy for decades, the revenue generated hasn’t been used to long-term, neither to educate the next generations and diversify its economy into other sectors, nor to create a better-regulated legal and business environment. The GDP in Suriname dropped to US$5,858 per capita in 2022 compared to the worldwide GDP per capita of about $US 12,607 and Guyana’s GDP per capita of US$ 18,199.

Despite the size and importance of this sector, Suriname does not have adequate legal, environmental and social frameworks for small-scale gold mining, which is the country’s main economic sector, producing about two-thirds of the nation’s gold. The mining department of the Ministry of Natural Resources has no systems or budgets for geological research or engineering work. This unregulated business environment has created the perfect conditions for transnational criminal activities, which benefit from relatively porous borders, stretched government resources (related to a lengthy economic crisis) and corruption.

IMF back in its 2017 report observed that Suriname had no institutional arrangements to save resources during its boom for future price corrections and its advice on strengthening the policy framework hasn’t been really taken into consideration. Even though Guyana is ahead of the game, by having established a Sovereign Wealth Fund in 2019 with an amount of $US 1.67 billion accumulated by April 2023, the challenge remains how to create sufficient transparency to avoid mismanagement of this wealth.

Indeed, what happened in Suriname is a classic example of a resource curse or paradox of plenty linked directly to the government corruption plague, – giant red flags for the Guyanese to look out for. The lack of the simultaneous development of transparency reforms and strong institutions based on the rule of law in the nations that are growing their extractions-based industry can be the combination of guaranteed failure and poverty.

Since the recent oil discoveries in the Guyana- Suriname Basin and Guyana’s colossal oil boom and skyrocketing economic growth, Suriname is impatiently watching this mouthwatering opportunity that is presented to them as well. With TotalEnergies and Apache offshore oil discoveries in Block 58, Suriname became more optimistic about its future hoping that this windfall would bounce them back out of the deep poverty its own leaders brought them into. Seems like the social unrest and economic chaos have dimmed a bit the oil exciting news around their deepwater discoveries causing some delays and caution for investors with the first offshore oil production being expected to be sometime in 2027.

Would this time around be different for Suriname?

We shall wait and see, but in in the meantime Suriname can do some watch and learn too from the Guyanese oil strategy in the past several years.

Cristina Caus is an International Economist and Oil and Gas/Energy Consultant and Business Developer. She has a rich, over a decade experience in the oil & gas industry worldwide and holds a master’s degree in international business from FIU.