U3O8 Corp. has arranged non-brokered private placement of up to 7,692,307 units at a price of 13 cents per unit for total gross proceeds of up to approximately $1.0-million. Insiders, who are among U3O8's largest shareholders, intend to participate, directly or indirectly, in the offering.

U3O8 Corp. has arranged non-brokered private placement of up to 7,692,307 units at a price of 13 cents per unit for total gross proceeds of up to approximately $1.0-million. Insiders, who are among U3O8's largest shareholders, intend to participate, directly or indirectly, in the offering.

Each unit shall consist of one common share of U3O8 and one share purchase warrant. Each warrant shall entitle the holder to purchase one share at a price of 18 cents for a period of 24 months from the closing date.

The securities issued and issuable pursuant to the offering will be subject to a four-month hold period. The offering is subject to a number of conditions, including, without limitation, receipt of all regulatory approvals.

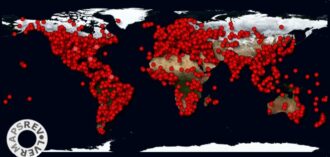

The net proceeds will be used to advance U3O8's Laguna Salada deposit in Argentina as a potential low-cost, near-term uranium producer, including refining the beneficiation process, completing the preliminary economic assessment and finalizing the definitive agreement to joint venture with Petromineras Chubut S.E., Chubut's provincial resource company, as well as for exploration projects in Colombia and Guyana and for general corporate purposes.